Study Guide Accounting Mastery Problems

- - - - - - - - - - - - - - - Accounting I is an introductory course to accounting, finance, and bookkeeping designed to give you a great start in the challenging, rewarding, and profitable field of accounting. The skills you will learn in this course should contribute significantly to your ability to “speak the language” of business, get a job, manage personal financial affairs, and to understand the economic activities of business. This course is also highly recommended if you are planning to further your education at the college level in the area of Business, as colleges require one or two semesters of college accounting for business degrees. Success in this course is simple. You will quickly find that if you always complete the chapter assignments, you will get the practice you need to do very well on the problem tests and quizzes. As they say, repetition hammers it home!

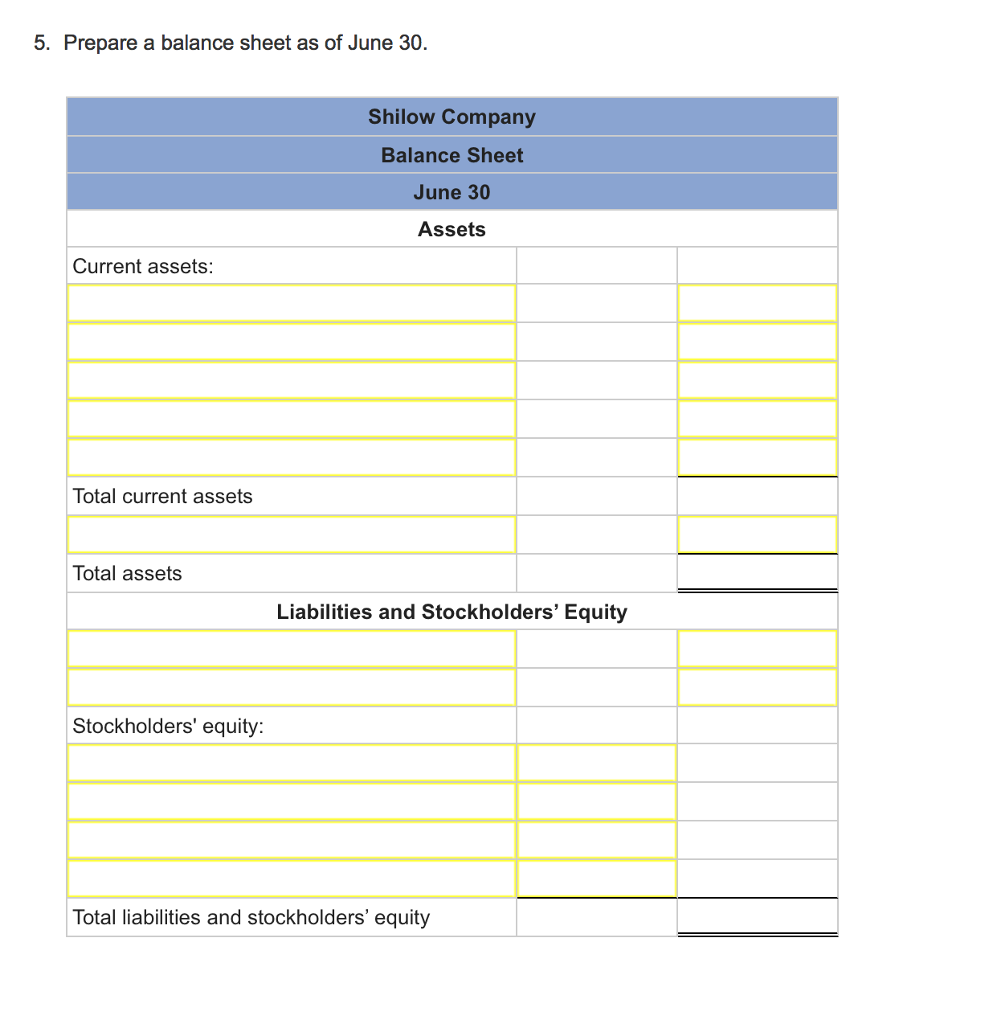

Identifying Accounting Terms. Terminal summary. 10-M MASTERY PROBLEM (LO2, 3, 4, 5, 6, 7), p. Accounting I. Course Syllabus. Grading Requirements: Homework (2 Parts) 50%. Application Problems (10%). Mastery Problems & Study Guides (40%).

The quizzes and tests are very similar to the chapter Mastery assignments, so there are never any surprises. The following list of assignments is designed to guide you in completing the chapter work.

Some of the chapter problems are completed in your workbook, while some are completed using MS Excel spreadsheets. For the spreadsheets, simply click on the hyperlinks to open the file you need. To avoid having late points deducted from your score, all problem assignments must be completed and submitted before the quiz. The chapter study guides and critical thinking assignments are always due the day after the test.

If you wish, complete the challenge problem at the end of each chapter to earn up to ten extra credit points that will be added to your test score, if needed, to raise your score to 100% The challenge problem must be turned in before you take the chapter test.

B-te02-study-17-20.qxd 10/24/07 3:11 PM Page 17 Study Guide 2 SECOND REVISED Perfect Score Name Identifying Accounting Terms Analyzing Transactions into Debit and Credit Parts Identifying Changes in Accounts Total 5 20 15 40 Your Score Pts. Part One—Identifying Accounting Terms Directions: Select the one term in Column I that best fits each definition in Column II. Print the letter identifying your choice in the Answers column.

Column II Column I Answers A. Chart of accounts 1. An accounting device used to analyze transactions. An amount recorded on the left side of a T account.

An amount recorded on the right side of a T account. Normal balance 4. The side of the account that is increased. A list of accounts used by a business. A COPYRIGHT © SOUTH-WESTERN CENGAGE LEARNING Chapter 2. 17 b-te02-study-17-20.qxd 10/24/07 3:11 PM Page 18 SECOND REVISED Part Two—Analyzing Transactions into Debit and Credit Parts Directions: Analyze each of the following transactions into debit and credit parts.

Print the letter identifying your choice in the proper Answers columns. Account Titles A.

Accounts Receivable— Imagination Station C. Nichols, Drawing H. Rent Expense D. Prepaid Insurance E. Accounts Payable— Suburban Office Supplies F. Nichols, Capital Answers Debit Credit 1–2. Received cash from owner as an investment.

Chapter 5 Study Guide Accounting

Paid cash for supplies. Paid cash for insurance. Bought supplies on account from Suburban Office Supplies. Received cash from sales. Sold services on account to Imagination Station. Paid cash for rent.

Study Guide Accounting Grade 11

Received cash on account from Imagination Station. Paid cash to owner for personal use. Paid cash on account to Suburban Office Supplies.

36) 18. Working Papers TE CENTURY 21 ACCOUNTING, 9TH EDITION b-te02-study-17-20.qxd 10/24/07 3:11 PM Page 19 Name SECOND REVISED Date Class Part Three—Identifying Changes in Accounts Directions: For each of the following items, select the choice that best completes the statement. Print the letter identifying your choice in the Answers column. The values of all things owned (assets) are on the accounting equation’s (A) left side (B) right side (C) credit side (D) none of these. The values of all equities or claims against the assets (liabilities and owner’s equity) are on the accounting equation’s (A) left side (B) right side (C) debit side (D) none of these. An amount recorded on the left side of a T account is a (A) debit (B) credit (C) normal balance (D) none of these. An amount recorded on the right side of a T account is a (A) debit (B) credit (C) normal balance (D) none of these.

The normal balance side of any asset account is the (A) debit side (B) credit side (C) right side (D) none of these. The normal balance side of any liability account is the (A) debit side (B) credit side (C) left side (D) none of these. The normal balance side of an owner’s capital account is the (A) debit side (B) credit side (C) left side (D) none of these. Debits must equal credits (A) in a T account (B) on the equation’s left side (C) on the equation’s right side (D) for each transaction. Decreases in an asset account are shown on a T account’s (A) debit side (B) credit side (C) right side (D) none of these. Increases in an asset account are shown on a T account’s (A) debit side (B) credit side (C) left side (D) none of these. Decreases in any liability account are shown on a T account’s (A) debit side (B) credit side (C) right side (D) none of these.

Increases in a revenue account are shown on a T account’s (A) debit side (B) credit side (C) left side (D) none of these. The normal balance side of any revenue account is the (A) debit side (B) credit side (C) left side (D) none of these. The normal balance side of any expense account is the (A) debit side (B) credit side (C) right side (D) none of these. The normal balance side of an owner’s drawing account is the (A) debit side (B) credit side (C) right side (D) none of these. A COPYRIGHT © SOUTH-WESTERN CENGAGE LEARNING Chapter 2. 19 b-te02-study-17-20.qxd 10/24/07 3:11 PM Page 20 SECOND REVISED Study Skills Attendance and Promptness Being in the proper place at the proper time is certainly one of the most important things you can do while you are in school. Attendance and promptness affect your grades.

If you are not in class, you cannot possibly get all the information that you need to complete all the accounting activities in your lessons. If you are not prompt, you are sure to miss valuable information. A Good Relationship Attendance and promptness also affect the teacher-student relationship. When you are in your seat before class begins every day, you are saying to the teacher, “I believe you have something important to say, and I am ready to learn.” This is the foundation of a good relationship. When you miss a class, you are in effect saying to the teacher, “I do not believe that the class is worth attending.” This is precisely the wrong message to send. You might ask, “How many absences may I have in this class?” When you do, you are telling the teacher that you want to do exactly what is required and no more. This is also the wrong message to send.

If you arrive late, you may distract the teacher and all other members of the class. This can result in the wrong kind of attention as well as embarrassment. When some students are a few minutes late, they do not go to the class at all. Even though entering late is not good, it is still better than missing class altogether. Causes of Absence and Tardiness There are a number of things that could cause us to miss a class.

Serious illness could be our excuse, but it is seldom the actual cause. Family responsibilities often are blamed, but the real problem is usually a lack of planning. Sometimes we are not prepared for class, and we would rather miss the class than admit we have not completed an assignment. This can be corrected easily by preparing for class. There are also a number of reasons for being late. Car trouble is often the excuse given, but in most cases the actual reason is a lack of proper planning. Not enough time was set aside to allow for any problems that could develop.

Preparing properly and allowing enough time to get to class can usually prevent absence and lateness. It makes little sense to miss class or to be late. Getting to class on time every day is the easiest part of making a good grade and a good impression. The good study skills you develop in your accounting class will be valuable as tools to apply in the workplace. Attendance and promptness are key success drivers for all employees. 20.

Working Papers TE CENTURY 21 ACCOUNTING, 9TH EDITION BTECh02-21-32.qxd 10/24/07 3:13 PM Page 21 SECOND REVISED Name 2-1 Date Class WORK TOGETHER, p.